Evaluation of different stochastic processes for the

convenience yield for

crude oil

Adriaan Krul

Site of the project:

ING Bank

Foppingadreef 7

1102 BD Amsterdam

start of the project:

December 2007

In February 2008 the

Interim

Thesis has been appeared

and a

presentation has been given.

The Master project has been finished in July 2008

by the completion of the

Masters

Thesis

and a final

presentation

has been given.

For working address etc. we refer to our alumnipage.

Summary of the master project:

Nowadays, traders calibrate the so-called convenience yield (CY) via

market

data every two days, using the forward price. The convenience yield is

the

benefit or premium associated with holding an underlying product or

physical

good. Sometimes, due to irregular market movements such as an inverted

market, the holding of an underlying good or security may become more

profitable than owning the contract or derivative instrument, due to

its

relative scarcity versus high demand. An example would be purchasing

physical

bales of oil rather than future contracts. Should there be a sudden

drought

and the demand for oil increases, the difference between the first

purchase

price of the oil versus the price after the shock would be the

convenience

yield. This is seen in the market nowadays.

The market shows however that the CY behaves stochastically and has a

mean-reversion property. In the literature the CY often follows an

Ornstein-Uhlenbeck process and is then calculated by means of a

Kalman

filter. The disadvantage of this process is that the CY can become

negative

which can result in cost and carry arbitrage possibilities. If the CY

follows

a CIR model the negativity is not present. Again the CY is calculated

by

means of the Kalman filter. All results are applied on the crude oil

market

from a data set of three years. The aim of this project is to

implement the

Kalman filter and to numerically test both stochastic processes on the

crude

oil data and compare the results. After this a third, novel, process

will be

developed with the same properties (i.e. mean-reversion).

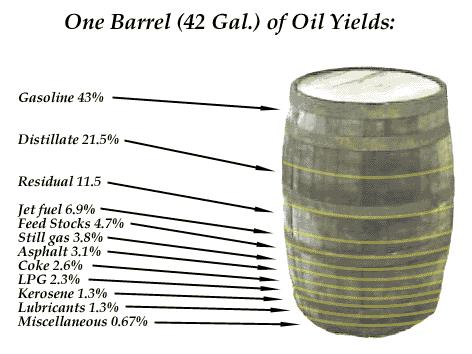

The contents of one barrel of crude oil

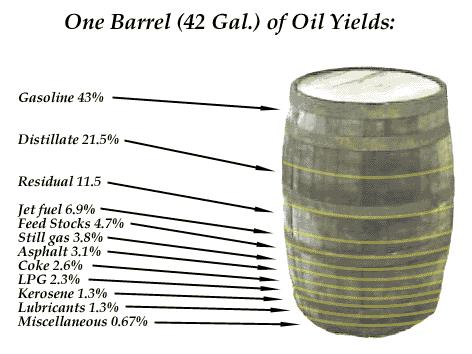

Market data for crude oil

Contact information:

Kees

Vuik

Back to the

home page

or the

Master students page of Kees Vuik

![]()

![]()